What do you mean by Incremental cost? Fmi Online

Posted on August 8th, 2022 by admin in Bookkeeping | No Comments »

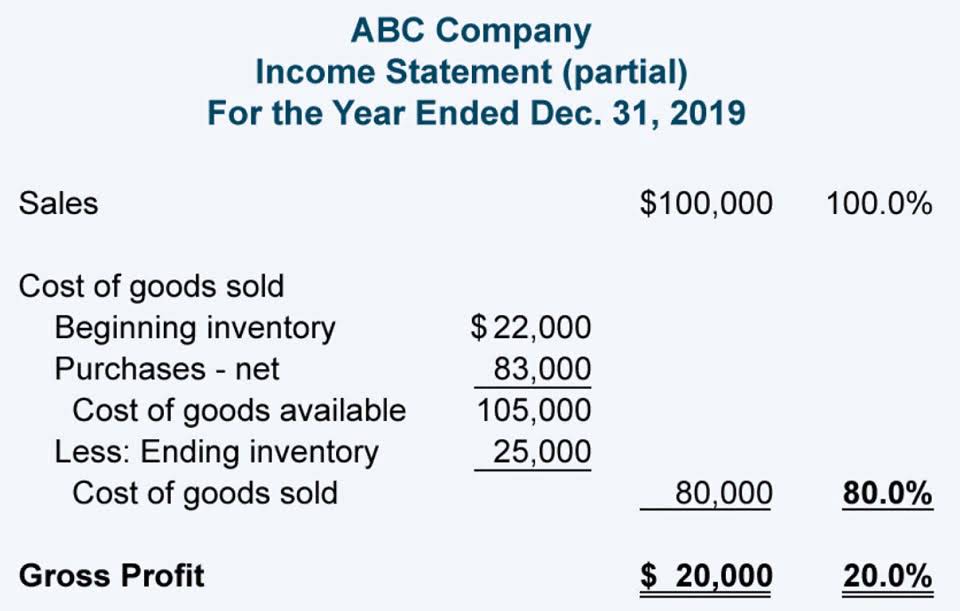

Let’s say, as an example, that a company is considering increasing its production of goods but needs to understand the incremental costs involved. Below are the current production levels, as well as the added costs of the additional units. The incremental cost is an important calculation for firms to determine the change in expenses they will incur if they grow their production. These additional charges are reported on the company’s balance sheet and income statement. As a result, incremental cost affects the company’s decision to expand or increase output. In this post, we define incremental cost, learn how to calculate it with a formula and see an example of how it might assist a business make profitable decisions.

Identifying Relevant Costs

This allocation can even change in the future course of business of ABC Ltd. when supposedly, if it chooses to drop product ‘X,’ then product ‘Y’ or any other product might become the primary user of the cost. In an equilibrium state, markets creating negative externalities of production will overproduce that good. As a result, the socially optimal production level would be lower than that observed. A leveraged buyout (LBO) is a transaction in which a company or business is acquired using a significant amount of borrowed money (leverage) to meet the cost of acquisition.

Allocation of Incremental Costs

- For example, the incremental cost of an employee’s termination includes the cost of additional benefits given to the person as a result of the termination, such as the cost of career counseling.

- It provides guidance regarding decision-making for the management in terms of pricing, allocation of resources, planning or production quantity, sales target, profit target, etc.

- The endeavour to calculate and precisely estimate such expenses aids a corporation in making future investment decisions that can boost revenue while decreasing costs.

- When the marginal social cost of production is greater than that of the private cost function, there is a negative externality of production.

- You calculate your incremental revenue by multiplying the number of smartphone units by the selling price per smartphone unit.

- A notable example is the long-run incremental cost of lithium, nickel, cobalt, and graphite as important raw materials for creating electric vehicles.

- Sensitivity analysis is a technique used to assess the impact of changes in key variables on the overall outcome of a decision or project.

Economies of scale occur when expanding production results in cheaper costs because the costs are spread out over a greater number of commodities produced. When incremental costs are added, the fixed costs normally do not change, implying that the cost of the equipment does not vary with production levels. The overall cost incurred as a result of producing an additional unit of product is referred to as incremental cost.

- The reason why there’s a lower incremental cost per unit is due to certain costs, such as fixed costs remaining constant.

- If a business is earning more incremental revenue (or marginal revenue) per product than the incremental cost of manufacturing or buying that product, then the business earns a profit.

- Incremental costs are the costs linked with the production of one extra unit, and it considers only those costs that tend to change with the outcomes of a particular decision.

- Understanding incremental costs can assist businesses in increasing production efficiency and profitability.

- While the output when marginal cost reaches its minimum is smaller than the average total cost and average variable cost.

Understanding Incremental Analysis

Companies utilize incremental revenue as a comparative measure with their baseline revenue level to calculate their return on investment. They may then determine how much money they can afford to spend on marketing efforts and how much sales volume is required to generate a profit for the company. They are always composed of variable costs, which are the costs that fluctuate with production volume. As a result, the total incremental cost to produce the additional 2,000 units is $30,000 or ($330,000 – $300,000). It is similar to marginal cost, except that marginal cost refers to the cost of the next incremental cost unit. Remember, identifying relevant costs requires a holistic approach, considering both short-term and long-term implications.

Incremental costs are expenses, and producing more units at a particular volume can outweigh the benefits. Here are some incremental cost examples based on different scales of production. In a low-cost pricing strategy where the incurred incremental cost decreases production cost per unit, the company may opt to reduce its selling price to stimulate demand and gain a competitive advantage. Profitable business decisions include knowing when is the best opportunity to produce more goods and sell at a lower price. Incremental costs are additional expenses a business spends to expand production.

You calculate your https://www.bookstime.com/ incremental cost by multiplying the number of smartphone units by the production cost per smartphone unit. Understanding incremental costs can help a company improve its efficiency and save money. Incremental costs are also useful for deciding whether to manufacture a good or purchase it elsewhere.

A variable cost is a corporate expense that varies in relation to the amount of product or service produced or sold. Variable costs rise or fall in relation to a company’s production or sales volume, rising as production increases and falling as production drops. A notable example is the long-run incremental cost of lithium, nickel, cobalt, and graphite as important raw materials for creating electric vehicles.

Incremental analysis, also known as the relevant cost approach, marginal analysis, or differential analysis, disregards any sunk or prior cost. If the LRIC rises, it is likely that a corporation will boost product pricing to meet the costs; the inverse is also true. Forecast LRIC is visible on the income statement, where revenues, cost of goods sold, and operational expenses will be altered, affecting the company’s total long-term profitability. That is why it is critical Online Accounting to understand the incremental cost of any more units.

How To Calculate Incremental Cost

The marginal cost is used to optimize output, whereas the incremental cost is used to determine the profitability of activities. It also helps a firm decide whether to manufacture a good or purchase it elsewhere. For example, while a monopoly has an MC curve, it does not have a supply curve.