Yearly Balance Sheet excel template for free

Posted on March 7th, 2025 by admin in Bookkeeping | No Comments »

‘Balance sheet’ is one of those terms that can fill an entrepreneur with dread. Thus, The balance sheet provides year to date balance sheet template an overview of the state of a company’s finances at a moment in time. It cannot give a sense of the trends playing out over a longer period on its own.

How to do a yearly profit and loss statement?

Then, save the form within DocHub, export it to your selected location, or share it via a link or email. Use the DocHub tools to add and arrange form fields like text areas, signature boxes, images, and others to your document. This is where you’ll create your forms and manage your document workflow. Choose a dashboard that integrates seamlessly with your accounting system, whether it’s QuickBooks or Xero. Ensure the automation capabilities match your reporting frequency requirements and can handle your transaction volume effectively. Liabilities represent everything your business owes to others, such as vendors.

What is considered a profit and loss statement?

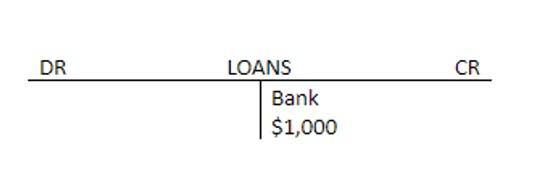

The whole reason for doing a balance sheet is to show that your accounts are in balance. If this check row displays “0” then you know your total assets are equal to your liabilities plus equity, as the formula states. Please be wary of making any changes to the excel sheet if you do not understand how to use basic excel formulas.

Free Balance Sheet Templates

While Excel offers basic templates, they often lack the specificity and customization that businesses require for accurate financial reporting. Our yearly balance sheet template fills this gap, offering a tailored solution that integrates seamlessly with Excel and other popular spreadsheet tools. An unclassified balance sheet provides minimal information, only presenting totally balances for assets, liabilities, and owner’s equity. While classified balance sheets breakdown assets, liabilities, and owners’ equity into subcategories. Classified balance sheets tend to be more popular because they provide more detail to the financial statement reader. We’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors.

- Dive into the world of Excel Templates today and transform your number-crunching experience into an effortless journey of discovery and efficiency.

- Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E).

- It automatically consolidates data from QuickBooks or Xero to give you instant insights into critical metrics like Current Assets, Accounts Receivable, and Cash and Cash Equivalents.

- They also reduce the risk of human error, ensuring that financial reports remain accurate and compliant.

- Learn how to format your balance sheet through examples and a downloadable template.

- Please be wary of making any changes to the excel sheet if you do not understand how to use basic excel formulas.

You can save this daily balance sheet template as individual files — with customized entries — for each day requiring balance insights for any 24-hour period. If you are a current or prospective small business owner, it’s imperative that you track your liabilities and assets. Doing so will ensure you have accurate information regarding how your company invests and spends money. A complete balance sheet allows you to identify areas of concern and patterns in profit and loss. Plus, find helpful tips for using a fixed assets small business balance sheet template.

Year-to-Date (YTD) Excel Template

- The entity you pick for your business is critical and will influence your daily operations, how you’re taxed, and your exposure to risk.

- Additionally, clients can securely upload financial documents, respond to requests, and review reports within the platform, making the process smoother and more transparent.

- Meticulously examine your created Year to date Balance Sheet Template for any discrepancies or essential adjustments.

- Otherwise, you’ll have inaccurate financial statements and distorted financial ratios.

- Our template offers flexibility to adapt to any of these types, providing a robust tool for your financial assessment needs.

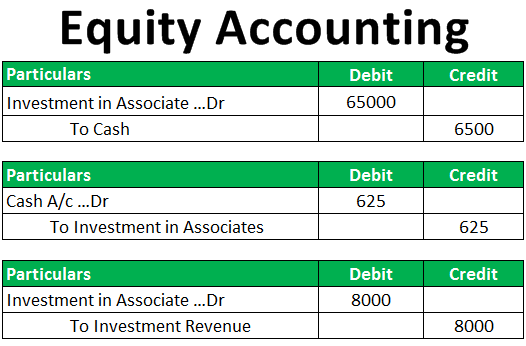

These include cash, receivables (how much you are owed by third parties), prepaid expenses and prepayments. Year to Date (YTD) refers to the period from the beginning of the current year to a specified date before the yearend. In other words, year to date is based on the number of days from the beginning of the calendar year (or fiscal year) up until a specified date. It is commonly used Airbnb Accounting and Bookkeeping in accounting and finance for financial reporting purposes.

Learn how to prepare a balance sheet and how important they are in business. Non-current liabilities (or long-term liabilities) are those liabilities which are due to be paid back but over a long time period, usually longer than a year. These often include things like long term loans and deferred tax liabilities. Non-current assets (or long-term assets) are those assets which have a useful life longer than a year. These are often broken down further into two groups, tangible assets (tools, equipment, vehicles) and intangible assets (goodwill, patents, trade names etc.).