Income Statement: How to Read and Use It

Posted on May 4th, 2021 by admin in Bookkeeping | No Comments »

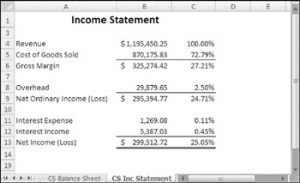

By understanding the income and expense components of the statement, an investor can appreciate what makes a company profitable. The income statement is an essential financial document that details your company’s income and expenses over a specific period. This document communicates a wealth of information to those reading it—from key executives and stakeholders to investors and employees. Being able to read an income statement is important, but knowing how to generate one is just as critical. A multi-step statement splits the business activities into operating and non-operating categories. The operating section includes sales, cost of goods sold, and all selling and admin expenses.

A line-by-line analysis of an income statement

Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more. Your interest expense is what you spend to pay off your small business loans or lines of credit. In some cases, if your company has investments in stocks, the interest or dividends you receive is reported here as income. You’ll look at your revenue later when it’s time to determine your profit margin—the relationship between how much you spend versus how much you earn. Net profit, also called “net sales” or “net earnings,” is the total profit for your business. How you calculate this figure will depend on whether or not you do cash or accrual accounting and how your company recognizes revenue, especially if you’re just calculating revenue for a single month.

Income statements serve as an indicator of how successful the implemented strategies are and whether there are areas that need improvement. It starts with the top-line item which is the sales revenue amounting to $90,000. The illustration above comprehensively shows the different levels of profitability of XYZ Corporation. This is used to fund public services, provide goods for citizens, and pay government obligations. This metric evaluates the efficiency of a company at utilizing its labor and supplies in producing its goods or services.

With the income statement detailing the categories of revenues and expenses of a company, management is able to see how each department of a company is performing. A single-step income statement is useful when your business does not have complex operations or only needs a simple statement that could report the net income of a business. All programs require the completion of a brief online enrollment form before payment.

Shaun Conrad is a Certified Public Accountant and CPA exam how to announce the relocation of a business expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. When you depreciate assets, you can plan how much money is written off each year, giving you more control over your finances. Indirect expenses like utilities, bank fees, and rent are not included in COGS—we put those in a separate category. Income statements are designed to be read top to bottom, so let’s go through each line, starting from the top. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

Create a Free Account and Ask Any Financial Question

Your income statements are most powerful when used in tandem with your balance sheet and cash flow statements. The above example is the simplest form of income statement that any standard business can generate. It is called the single-step income statement as it is based on a simple calculation that sums up revenue and gains and subtracts expenses and losses. The income statement is an integral part of the company performance reports.

Step 2 of 3

This can be facilitated by advanced accounting software, which automates and minimizes errors in entries. As you start preparing income statements, here are three factors to consider to make the process easier and ensure accuracy. Here is an example of how to prepare an income statement from Paul’s adjusted trial balance in our earlier accounting cycle examples. A balance sheet shows you how much you have (assets), how much you owe (liabilities), and how much is remains (equity). It’s a snapshot of your whole business as it stands at a specific point in time.

Updates to your enrollment status will be shown on your account page. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program. Comparing what is a periodic inventory system + when to use it these numbers, you can see that just over 30% of Microsoft’s total sales went toward costs for revenue generation. The company also realized net gains of $2,000 from the sale of an old van, and incurred losses worth $800 for settling a dispute raised by a consumer.

But you can anticipate your future by creating hypothetical income statements for the accounting periods to come. A lot of business owners focus their attention on the bottom line—their net profit. There’s only so much you can do to improve your bottom line by cutting expenses. At some point, you’ll hit a ceiling, and the only way to grow the bottom line is to grow your revenue.

- We offer self-paced programs (with weekly deadlines) on the HBS Online course platform.

- Learn to analyze an income statement in CFI’s Financial Analysis Fundamentals Course.

- Some of these expenses may be written off on a tax return if they meet Internal Revenue Service (IRS) guidelines.

- Competitors also may use income statements to gain insights about the success parameters of a company, such as how much it is spending on research and development.

- A single-step income statement is useful when your business does not have complex operations or only needs a simple statement that could report the net income of a business.

The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. To calculate total income, subtract operating expenses from business finance gross profit. This number is essentially the pre-tax income your business generated during the reporting period. This can also be referred to as earnings before interest and taxes (EBIT). An income statement is a financial report detailing a company’s income and expenses over a reporting period. It can also be referred to as a profit and loss (P&L) statement and is typically prepared quarterly or annually.